Liquidity Pools (LPs)

Liquidity providers on Loop DEX earn a share of swap fees.

To provide liquidity, create LP tokens by combining two tokens of equal UST value. LP tokens prove the liquidity was provided and also established partial ownership of that Liquidity Pool - including a share of that LP's transaction fees revenue.

Example

You deposit LOOP and UST into a LP. You receive LOOP-UST LP tokens proving that you own 1% of the entire LP.

Another trader then swaps UST for LOOP on Loop DEX - and pays a 0.3% trading fee.

That total fee of 0.3% total divides into:

0.225% added to that LP

0.075% allocated to $LOOP staking rewards

You, as 1% owner of the LP, receive 1% of the trading fee.

See the estimated yield from providing liquidity on the pool page.

Token Pairs

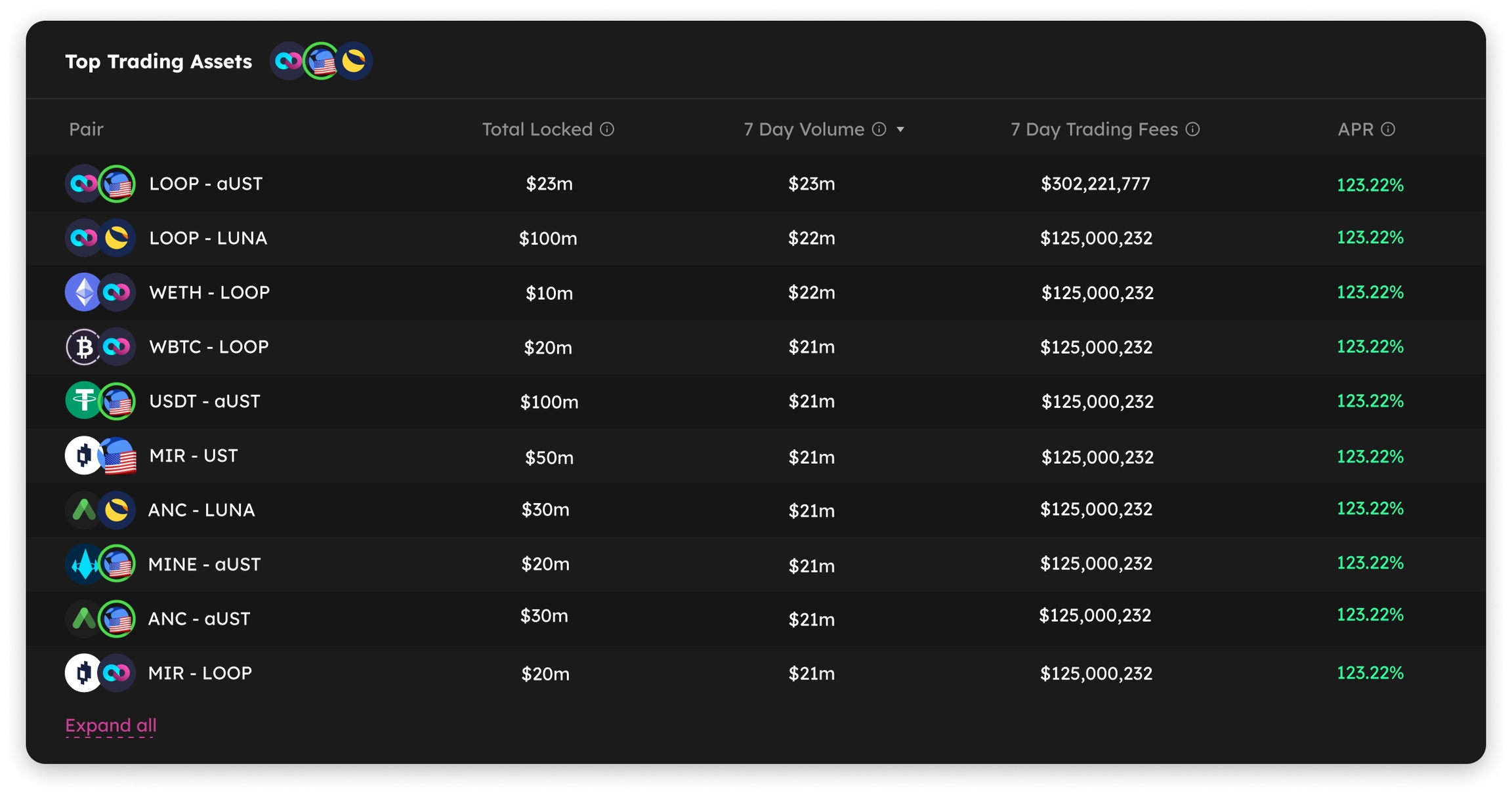

Available liquidity pools are shown on the pool page.

Pair = Assets contained in the liquidity pool (LP)

Total Locked = Total value of assets locked in the LP (in UST)

7 Day Volume = Total volume of swaps in past 7 days (in UST)

7 Day Trading Fees = Total trading fees accumulated in past 7 days (in UST)

APR = Annual Percentage Rate

Providing liquidity is not a lossless investment. Before investing in liquidity pools, users are encouraged to conduct their own research.

Last updated